How do the extremely wealthy invest their money?

You're invited to join our exclusive alternative investment community.

- Diversify portfolio with an alternative investment class

- Historically safe with low risk and high returns

- 100% immune to stock, bond, or crypto market crashes

- Available only to high net worth CA investors

- Decades-old favorite of Warren Buffett, Bill Gates, & Hedge Funds

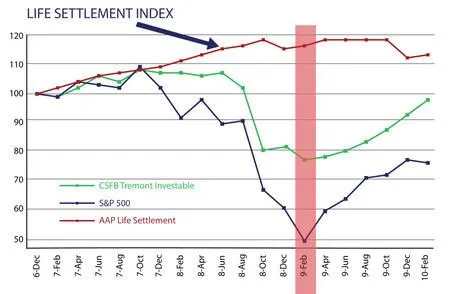

Asset Performance vs. S&P 500 During 2008 Crisis

Past performance is no guarantee of future results, and there are significant differences between investing in life settlements and investing in equities and other asset classes.

.

.

Reasons To Invest With Us

- Life Expectancy (LE) Reports

- Most Desirable Policies Available On Market

- Employee Independent Escrow & Trust Company

- Mature, Veteran Experience In LS Market

50+

Total Policies

1600+

Approved Members

$4M+

Policy Average

$103M+

Raised

.

High Yields, Low Risk.

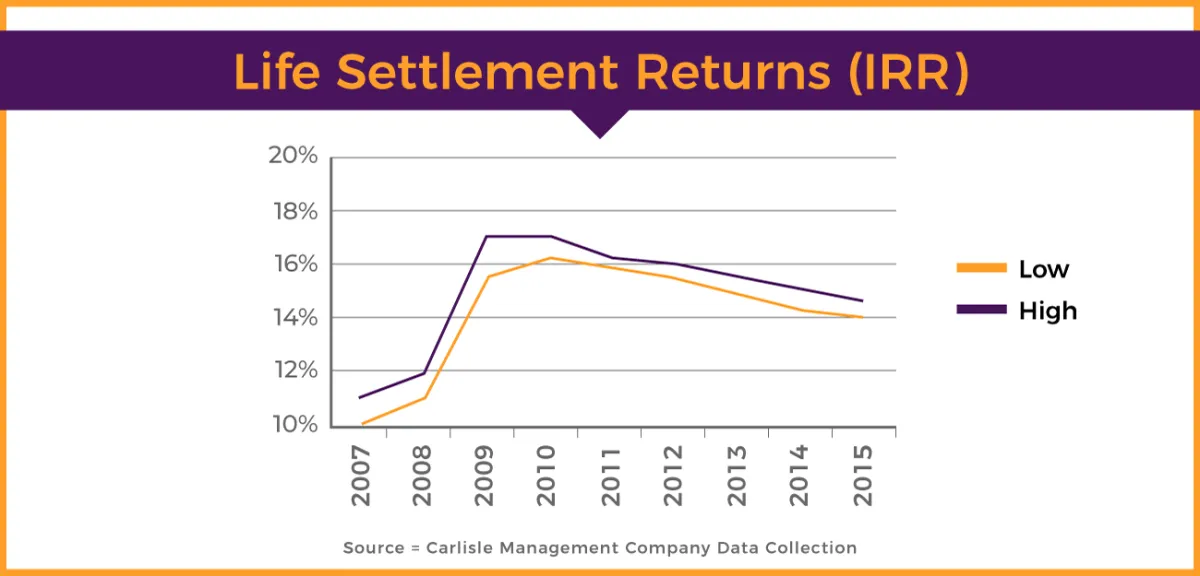

Data collected by the Carlisle Management Company (shown here) beginning in 2002 showed a consistent double-digit internal rate of return (IRR) on their life settlement portfolio over a 13 year period.

And, although individual cases will vary in performance and past performance isn’t indicative of future success, Reliant Life Shares’ own experience has shown that double-digit returns have been common in life settlement investments.

Life Settlement Investmenting

Duis aute irure dolor in reprehenderit in voluptate velit esse

Download nowThe Process: An Example of How it Works

.

Jon Sells His Policy

He's 83 years old with an annual premium payment of $38K.

Reliant Investors Purchase Policy

Jon is ill (life-expectency of 47mo) and is paid $634K for his policy.

Jon Passes

$1.1M death benefit is paid to Reliant investors.

47 Month

$152K premiums paid with a 10.27% net return.

36 Months

$114K premiums paid with a 15.7% net return.

Study: Life Settlements Deliver 12%+ Historical Returns

History has demonstrated that life settlements can produce double-digit investor returns. For example, a 2013 study published by the London Business School found that the average expected return among institutional life settlement investors was OVER 12% annually.

In addition to offering a strong risk/reward proposition and providing a safe haven from turmoil in the markets, life settlements present a socially responsible investment opportunity that offers a win-win scenario for both parties

@ Copyright 2025 - All Rights Reserved - Reliant Life Shares - Privacy Policy